So a comment to a previous post came up requesting I “run the numbers” for a slightly different situation than normal. As you can no doubt tell from the title of this post, we’re using the example of a lower than “average” Australian income as well as the dreaded, always hideously expensive child! On the plus side we have a relatively small mortgage by most Australian’s standards. Summing it up though we have:

- $150,000 Mortgage (at say 5% interest rate)

- Single mother income of $50,000

- 1 child to take care of

Income:

According to the ATO’s Simple Tax Calculator:

| Jill’s Base Income: $50,000.00 |

| Jill’s Annual Tax: -$7,797.00 |

| Jill’s Current HELP Debt: $0.00 |

| Jill’s Take Home Pay: $42,203.00 |

Total Income After Taxes: $42,203.00

Total Income: $1,623.19 Per Fortnight

Expenses:

Now I’m not sure what expenses a single mother with one child would have. I’m sure this would vary greatly on many things like how old the child is, if the mother is receiving alimony or government assistance, if the child is going to a private or public school and so on. Generally though I like to think children cost at the very worst, slightly less than full grown adults. As such I’ve put together a general list to estimate what their expenses might be.

| Gas: | $600 |

| House Insurance: | $900 |

| Internet: | $720 ($60 Per Month) |

| Power: | $700 |

| House Rates: | $1,000 |

| Water: | $800 |

| Food: | $6,240 ($120 Per Week) |

| Car Insurance: | $800 (1 Car) |

| Car Rego: | $750 (As Of 2015) |

| Car Petrol: | $2,340 ($45/Week Travelling 430km) |

| Car Services: | $500 (1 Car) |

| Mobile Phone: | $360 ($30 Per Month * 1 Phone) |

| Private Health Insurance: | $2,300 (Mother + Child) |

| Presents (Birthdays/Christmas/Easter): | $2,000 |

| Sports/Exercise: | $800 |

| Child ($100/week): | $5,200 |

| Total Expenses: | $26,010 Per Year |

| Total Expenses: | $1,000.38 Per Fortnight |

You’ll note I’ve also added in a “child” cost of $100 per week on the end there. As in previous posts, this is what the ABS seems to think is pretty much the top range of child care costs are for an average child and as I’ve never been a parent before, it’s the only trusted source I’ve got!

The average net cost to parents for formal care (taking into account the Child Care Benefit and Child Care Tax Rebate entitlements) was $53 per week. Children who attended long day care had the highest average net weekly cost of $73, reflecting the average hours per week children spend in long day care (19 hours). Over half of all children who usually attended formal care (55%) had net costs of less than $40 per week. Almost 30% of children in formal care had a net weekly cost of $40-$99 and 15% of children had a net weekly cost of $100 or more. [Citation]

The Loan:

Now when I needlessly prattle on about 70% of your wage should be going towards your mortgage I hope most realise that this is a percentage based rule, and thus doesn’t scale too well when dealing with progressively smaller and smaller income amounts. If you make $300 a week I’d hardly suggest putting 70% of it towards your mortgage! I am fully aware not everyone makes the average Australian wage and my answer to that statement is that if you’re NOT making the average Australian wage (or higher) then you need to have a good hard look at the figures and understand how much you should be borrowing. Earning $50,000 and then borrowing $500,000 is a stupid move! You will go through hell trying (and probably failing) to pay that off and no amount of telling me “oh your rule doesn’t work” will make that not a stupid move.

Instead, come at the problem from the opposite side. Acknowledge your income, do the calculations and find out what type of loan you can get that you’ll be able to pay off easily and within your time frame. THEN go buy a house for that amount, regardless of whether you think it’s “not enough” or not. If you’re new here, I specifically wrote a post about this a while ago. Anyway, back to our case study and Jill thankfully has done the smart thing and not got debt up to her eyeballs. Hers is only $150,000 and so we have the following:

- Total Income: $1,623.19 Per Fortnight

- Total Expenses: $1,000.38 Per Fortnight

- Amount To Mortgage: $622.81 Per Fortnight

Note this amount is 38% of her total income, so she’s not quite at 70% just yet. To get there you can come at it from either the “cutting expenses” side or “earning more” side. Both will be difficult with her already low income and likely time poor lifestyle (due to being an only parent). One thing to note is that earning more doesn’t have to be super time consuming. A lot of people equate specific time to a specific amount of money. If I made $10 for 1 hour, I can make $50 working for 5 hours. But as they say, work smarter not harder! Learning how to negotiate your salary can be a VERY highly paying skill to have and doesn’t take long to learn either. Head on over to I Will Teach You To Be Rich and have a read up on some of his free information (that guide has many other great bits of information in it too!).

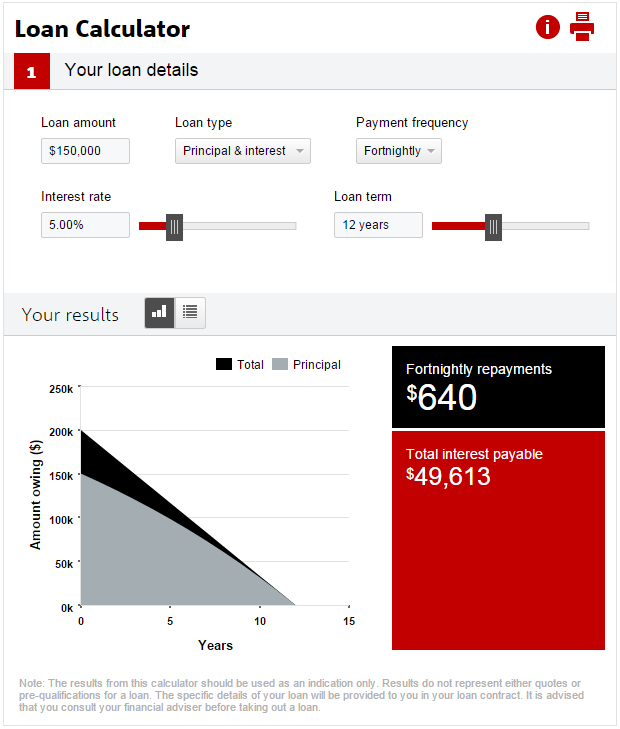

So with $622.81 per fortnight going to the loan we jump over to a Loan Repayment Calculator and punch in the figures. I’ve assumed an ongoing interest rate of 5% p.a. here however do note these historically low interest rates likely won’t stay around much longer. It’s quite likely interest rates will rise to 8%+ over the next 5 years time. Regardless, at 5% and repayments of $622.81 per fortnight it shows this mythical single mother can borrow $150,000 and pay it all off in 12 years.

12 years isn’t our usual sub-10 year numbers here at MTM, however as said above this is just a start. I set 70% as a goal to achieve not a strict rule. If you’re not getting 70% that’s fine! Get it as high as you can and be proud of that! Just realise that it is possible to get there eventually whether that’s by negotiating a bigger salary, cutting expenses ruthlessly or doing both at the same time. Aim high and focus on being happy with every percentage point you get.

The Results:

So in the end we have a single mother with a child that’s not earning a super high salary. The result though is that she should be able to pay off her mortgage in 12 years, not a bad result! A lot of HIGH, dual income earners out there still go into retirement with a mortgage!

What about everyone else out there reading this, did you come from a low income earning point and are now raking in the big bucks? What would be your helpful piece of advice to Jill here? Should she go for further lowering of expenses, increasing income, or something else…?

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).