Every year back when we had a mortgage I reviewed it.

Over time things of course change and thus what you currently have might not be the best thing anymore. If you’re on a $50/month phone plan with 10 GB of data and there’s a $40/month plan that gives you the same thing it’s not too bad. Sure, you’re missing out on a savings of $120 a year but overall it’s not the end of the world.

When it comes to your mortgage though… everything is amplified. Maybe you’re interest rate is 3.5%. When was the last time you checked what other home loan rates were out there? Perhaps there’s one with all the features of your current mortgage plan but at 3%! If you have a $400,000 loan that’s a savings of $2,000 a year!

Table of Contents

Check Your Rates

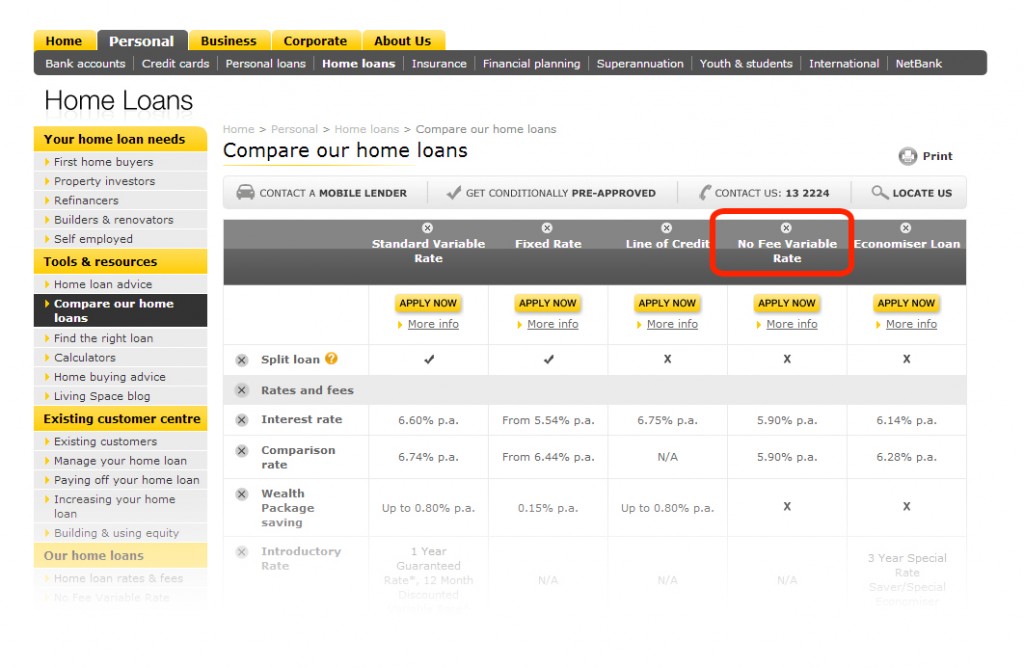

The very first thing to check is your own bank. What mortgage plans do they have currently?

This is an easy step as you can just go to their website and check. Do they have any mortgage plans that are cheaper than the one you’re on? Maybe it’s a more basic plan than the “package” you’re on now.

Checking with your own bank first is a great idea as it’s far cheaper switching plans with them than switching banks entirely. You also have a bit of leverage over them as well which means you can demand more. For example you could ask them to move you down to the basic, no frills package. Some banks might demand you pay a fee for this but if you’ve been with them for a while it’s not too hard to push back.

“I’ve been a customer with your bank for ____ years now. What can you do to help me not pay that downgrade fee?“

This is a simple tactic but one that works wonders for banks, phone plans, basically any bill. Never demand the company/person to do something. Always ask them to help you achieve that something. So rather than saying “You need to get rid of that fee!” use the script above.

Phrasing it this way is far less threatening and creates a bond between you and the other person. Together, you’re now working to help achieve a goal. This is much more likely to end in success for you than fighting against them and “demanding” things. You get more bees with honey ;-)

Check Other Banks Rates

If your own bank hasn’t made any changes then maybe others have. Check major banks. Have a look at credit unions. Check smaller lenders. Go online and find online interest rate comparison tools.

Even if you find a slightly better deal and don’t really want to move to that other bank, you can sometimes bargain down your current bank with the threat of leaving.

The one rule to remember trying to do this though is that your current bank will know how much it’s going to cost you to move. You have to make sure that even when you take that cost into consideration, it’s still better off for you. This means that your threat has weight. You current bank can either suffer a little and keep you as a customer, or they can lose you for not being competitive.

Check You’re Mortgage Features Are Being Used

Do you have an Offset account? Do you have linked credit cards? Wealth packages? Insurances or other things that are adding extra costs to your mortgage plan?

These things are all fine so long as you’re profiting from them!

Do some quick back of the envelope calculations for each thing you’re paying extra for. Make sure that whatever you’re paying for is indeed giving you more money. For example consider an Offset account. Perhaps the bank is charging you a $300 fee each year for it. Make sure you’re saving more than $300 a year in interest because of it.

This means that if your interest rate is 3.5%, you need to have $300 / 0.035 = $8,571 in the Offset account at all times. Preferably a lot more. You could also make use of Redraw and get the same benefits for no extra costs as Offset Accounts are pointless wastes of money.

Another example my be a Credit Card. Maybe you buy all your groceries and things on it all year which earns you special “points”. These points usually have a monetary value you can figure out some how. The most common way I do it is by finding how many points you need to buy a $100 gift card to a grocery store. Having a $100 grocery gift card is essentially the same as having $100 in cash as everyone needs groceries and it’s easily spent well.

So say you need 50,000 of these points to get a $100 groceries gift card. That means each “point” is worth $100 / 50,000 = $0.002. Thus if after buying all your things over the entire year you earn about 70,000 points, that means the value of that “perk” is 70,000 * $0.002 = $140.

Do you pay more or less than $140 per year to your bank for this Credit Card privilege?

Check Your Mortgage Once A Year

This is also a good time to just generally go over the details of your finances again for new insights. Maybe there’s something you can tweak a little bit to improve efficiency. Try and bump up your repayments amount and see where it takes you.

Although paying off a mortgage early is best achieved by setting up Automatic, Extra Mortgage Payments, you do still need to check in about once a year. Kind of like a car service :-)

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).