This is an extremely detailed series of posts that applies not only to First Home Buyers, but also to existing home-owners. The point is to cover the most major expenses and how to make sure that your mutilation powers are at their highest with all of them. You want details? Read these!

Bills. Do they EVER stop coming? That’s how I hear a lot of people feel about bills… however quite often I find myself excited to get them. I rip them open eagerly wanting to see “how good we did this quarter”.

You see, getting a bill for me is kind of like getting a report card in school, you’ve spent months putting in the effort of turning off the lights when you leave rooms, making sure that nothing is running over night or when you leave, using the fan instead of the air conditioner when it’s hot and so on. Getting that bill tells you just how good you’ve been, and like anything that tells you how good you’ve been, you can’t wait to see the answers.

OK… so maybe I’m “weird” on this one but I don’t care. It may be a funny quirk of my behaviour but it’s got way too many advantages to it for me to get rid of it.

Before I move on though, have you noticed that this series is a lot more detailed (and long) than what normally passes for “news” or “tips”? As I’ve said before, I want you to come to Mutilate The Mortgage for far more advanced, leading class help in getting rid of your mortgage debt. I try and keep things light hearted, but these posts are meant to be detailed, long and highly specific.

They make a sizeable number of people turn away because it’s “too much effort”. Good. I want to attract the ones that stay, the ones that read and learn and who actually take action as that’s what I want to see, people taking action and paying off their homes countless YEARS quicker than everyone else. These types of people are the “extreme minority” according to one friend who actually works in the home loan industry.

When I was starting out I read hundreds of extremely vague and short articles, posts, threads and so on all covering tiny little pieces of the puzzle… none of them seemed to give it to you all in one hit. I doubt anyone could ever give everything to you in one hit… but hopefully these will be a giant springboard as well as something you reference back to a number of times in the future as you take each step forward. Now then, “home bills” are the third instalment for this series and I’ll try and cover as broad a range as possible in this post. Rattling a few off the top of my head we have:

- Electricity

- Natural Gas

- Water

- Home and Contents Insurance

- Internet

- Council Rates

That’s a lot of bills. I will admit some bills I don’t get that excited about but they’re mainly the ones I know you can’t do much about such as Council Rates. To begin with though lets tackle the three main utilities, Electricity, Gas and Water. These are all generally under your control and here in Australia there is a sizeable push for everyone to be as efficient as possible.

Sites like Green Power and many other government based sites all promote and tell you about how to save everything from water to power. I’m guessing many people aren’t aware of them though as even now I see people being surprised by the fact that you can (for instance) get a big refund from the government when replacing your electric hot water system with a gas or solar one.

At the core of these three bills though are two sides, one is YOUR usage of them in the day to day and the other is the actual equipment you use. Equipment involves things like CFL light bulbs instead of halogens, gas hot water systems instead of electrical, water saving shower heads instead of old gushers, solar panels instead of nothing, water tanks instead of nothing, high rating insulation instead of no insulation, well-sealed fridges, doors, windows, thick blinds, energy efficient appliances and more.

To a lot of people these might be very obvious, however as this is a “Starting out on a role” post I’m going to briefly go over the major things for those who haven’t yet bought a home so they know what to look for or what to at least start researching when it comes to a major appliance purchase.

Table of Contents

Electricity

The most power efficient home is the one that requires NO power (durr). So your mission is to own a house that doesn’t require ANY electrical use while you go about your daily life. In order to accomplish this there are a lot of tricks and well known factors you should look for or setup. First off, there are features that keep your internal house temperature within a nice range making air con or heating irrelevant (at least for most of the year).

These include eves on your roof. The eve creates shaded area’s over the side of the house, lessening the effects of the Sun. Similarly any big trees that provide shade will also be a big help, however these can cause issues with animals getting onto/into your roof, fallen branches, fire risks, clogged gutters and so on. Insulation should be a KEY aspect of every home, if you have to purchase a house with poor insulation, pay to get it either replaced or upgraded.

If there’s none in your roof, get lots, you can rarely go overboard with insulation and you will be astounded at how much of a difference it makes. Double brick houses win over single brick as they act as further insulation keeping warmth in and the hot out. Thick blinds fully drawn and/or double glazed windows will also drastically cut down on that summer heat making air con unneeded. Continuing on, any type of heating is horrendously inefficient when using electricity.

This is normally further made worse when it comes to heating water with electricity as water takes a large amount of energy to heat up. So when looking at a potential home give any that have all gas heaters and all gas hot water systems more of a preference, as an indicator of just how much this can save you, the parents just recently converted from electric to gas hot water system and are now saving over $500 PER QUARTER in electricity. Insane.

The other side of this equation is that using electricity to heat up your home is also just as bad. A good electric heater can heat up a large living area… but will use about 2.5 kW/h to do this. Homes with gas heating should again get the higher preference as they’ll save you thousands in the long run. Next up is the dryer.

These things are almost always second in terms of power usage after an electric hot water system and the truth is they aren’t really needed at all. Many sites (governments included) propose using them “less” but I’m here to say just stop using them entirely or don’t buy one to begin with. We have never had one and after almost 4 years life is still grand.

The more children or people in the house, the harder it is to do without a dryer however a large cloths line will easily dry loads of washing in a few hours on a sunny day. If it’s raining, throw them on an inside cloths horse in a spare room (try and leave a door or window open though).

Finally you have the other common things such as the CFL light bulbs that last 5+ years and take up 1/5th of the power of halogens, turning off screens and appliances when they’re not used, only running ONE fridge in the house (no ancient crappy ones out in the garage please or a fridge on each level etc), leaving the lights off during the day and opening up the blinds, turning lights off when you’re not in the room (even if it’s for a minute or two), investing the money in buying efficient appliances when it comes time to replace old ones and then there’s just simply not watching the TV full stop, but I’ll address that in another post.

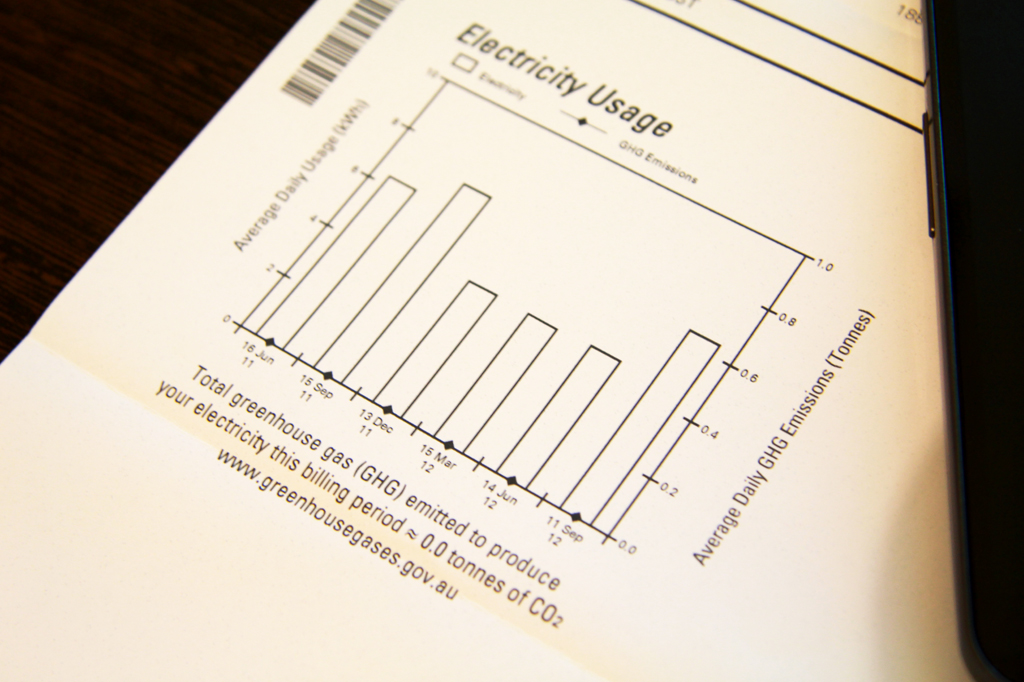

Doing all the above has allowed us to keep our power usage to around 3 kWh per person (it’s even less now too at around 2.5 kWh/person as we also have solar panels). Considering the cost of power has risen around 85% over the past 4 years according to my records, keeping this utility to as little as possible will not only save you thousands of dollars per year, it’s just plain better for the planet.

Water

If you haven’t already, get a water saving shower head installed, there’s once again government programs for this. Yes, it’s not as powerful as a non water saving shower head, this is something you will get used to after a week or two of use. Don’t believe me? Give it a try for 60 days and then see if you care enough to change back to the old shower head, my bet is that you won’t care and will just stick with it. More quick tips can also be found here.

Next up, I think should go without saying but I still notice a few people doing it so don’t leave taps just randomly running! If you’re not using the water for more than about 2-3 seconds turn that shit off. It’s just plain irresponsible and wasteful to have litres of fresh, clean water going to waste and there’s no excuse except that you’re being lazy.

Finally try and keep watering plants, washing cars and so on to a minimum. Use a bucket when washing the car and getting a water tank for the home is an excellent idea that not only saves you money but also again is just plain better for the planet. It will also add value to your home.

Gas

The thing that will make the biggest impact here will be ducted gas heating if you have it (and you should) so make sure you monitor this closely. If it’s cold in your house, the first thing you should reach for is your JUMPER, not your heater control. Dress like you are heading outside into the cold, if you’re STILL cold after you’re appropriately dressed for the outside weather then you can start thinking about turning the heater on.

Another great trick is to grab a spare doona cover rather than turn on the heater, these often provide huge amounts of warmth and are great for when you want to watch a movie etc. The other main user of gas is a gas hot water system if you have it (and you should). The main way to cut down here is to just have shorter showers and generally use the water less. Another option is to start experimenting with colder showers but I haven’t seen this make too much of a difference.

Now that we’ve covered the general equipment type things for these three main utilities I’m going to pause for a moment and address the use of them.

Usage Of Utilities

Just like usage of food, seems to be an extremely varied experience. Some have 20 minute showers every day, leave all the down lights in their house on 24/7, run the heating at 27 degrees and walk around in a tank top and more. Others rarely turn on the heater, have 3 minute showers and open the blinds for light.

There’s lots of different ways people use them and everyone (me included) has their cut off points, however whenever I think that I’d prefer not to do something because it’s “harder” just to save some power/water/gas I try and frame it more in terms of it being less wasteful, rather than to save money.

I also try and make it a challenge. Regardless of how you motivate yourself though, how you use, approach and respect the use of power/water/gas will make just as much a difference as buying a more efficient light bulb will. All the efficient appliances in the world won’t help you if you’re still leaving every one of them on 24/7 so try and tackle these two things simultaneously.

Start with how you use your utilities and finding ways to reduce them, at the same time keep an eye on or research things such as insulation and appliances to find where improvements can be made. As something breaks, make it a point to prioritise the most efficient thing as well as the smallest version. Buying a 500 litre fridge for two people was a mistake we made as although it can be handy on the odd occasion, it’s rarely used to it’s fullest.

We would have been much better off with a smaller one that would cost less to run all the time. Usage patterns are hard to change. They are normally habits we’ve formed over our entire lives but they CAN be changed and you will be pleasantly surprised at how you will quite likely PREFER the newer, more efficient option.

This is normally because you will find that the new way isn’t as bad as you had imagined plus you are saving money and helping the planet as well. If you’re moving into a new home it is also the perfect time to adjust your habits as it’s a new location. Make your new home as efficient as possible and you’ll find after a few months it will just be natural to turn lights off or throw on a jacket.

Home And Contents Insurance

The amount of this bill will be directly proportional to how much time you put in doing research and getting quotes. The more you research, the more it is you will save. I set a reminder every year one month BEFORE the bill is due to look over other options. A lot of places will give you a great first year price… then hike up the rates on the second year because they know it’s a barrier for people to move to another provider so be mindful.

I’d also recommend taking pictures of most things in the house once a year and uploading them to a free photo sharing site for security and verification purposes. It doesn’t take long to grab a point and shoot or DSLR or even your phone and take 3-4 pictures of each room. Plug the camera into the PC and upload them to a private album each year. If your entire house burns down tomorrow you’ll have no worries proving exactly what it is you had, it’ll also help you remember all the little things to claim for too.

Internet

Unfortunately here in Australia we seem to get stuffed around a lot with this. Customer service is horrible, prices are high (relative to International standards), contracts are stupidly complex, extra fees are everywhere and it’s just generally a PITA to get the service connected in the first place sometime taking weeks to do.

Your usage will vary of course depending on if you care for the Net or not as well as if you have kids or how many YouTube video’s you stream. You can of course get cheap plans with very little usage per month or with lesser quality providers however do be wary that you do indeed get what you pay for. We use a highly recommended provider but on their lowest plan to try and get the best of both worlds.

Whilst we don’t download 900 GB a month we do like our Internet to be working when we use it. An exceptionally good website for comparing all Internet providers in Australia is https://bc.whirlpool.net.au. Here they regularly run a nation wide survey of who is the best and why. We personally use iiNet and have had no troubles aside from the fact that their lowest price is $60 / month.

I’d be happier if they halved the bandwidth and halved the cost but due to Telstra’s monopoly on our copper network that isn’t going to happen any time soon. Hopefully after the NBN comes in we’ll start to see more competition and better plan options. As a side note, a big saving that you can make is by ditching the home phone subscription and simply going with “Naked ADSL”. Most younger couples we know do this as it saves money and they never use home phones anymore because they all have a mobile.

Council Rates

Unfortunately there really isn’t a GREAT deal anyone can do about these. The only thing I’ve been able to find out is that if you wish, you can appeal against your rate evaluation amount. This involves you putting in an appeal to the council basically saying that you disagree with the valuation of your property (and thus the rates charge calculated from it) however it doesn’t appear that anything too major would come out of doing this.

Councils are normally slow and painful to deal with and even if they do re-evaluate your property value, it isn’t likely to save you much money, so your time may be better used on optimising another expense category.

So that’s Home Bills… join me soon for part IV on Personal Bills…

<- Previous Post: Starting Out On A Roll Part II: Food

Next Post: Starting Out On A Roll Part IV: Personal Bills ->

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).