Paying Off Your Mortgage Faster is a very common dream for mortgage holders, who wouldn’t want that huge debt erased a bit quicker? Also very common is not usually having any plan or knowledge of how to do this! If you’re one of those dreamers wondering how to pay off a 30 year mortgage in 10 years, then read on, as we explain how to achieve this as well as show you a real life example of a young couple that did it and saved an obscene amount of money in the process – all stress free!

Table of Contents

Should You Pay Off Your Mortgage Faster?

Before we jump in, it’s important to do some quick checks regarding whether paying off your mortgage in 10 years (or just faster in general) is the best financial decision for you, given your unique circumstances. We’ve already covered this in our recent piece Should I Pay Off My Mortgage? so please make sure you take into consideration the points listed there first.

Make Automatic, Extra Repayments Each Month

The single most effective way to pay off your mortgage in 10 years is to make regular, automatic, extra repayments each month or fortnight. While we list many other ways below that can help, make no mistake, they pale in comparison to this one. Do. Not. Skip!

The recommended way to do this is to setup an Automatic, Extra Mortgage Payments each time your normal payment comes out. This allows you to not only change the amount quickly and easily in the future, it also makes the process automatic, greatly increasing the likelihood you’ll stick to it throughout the long term.

Don’t be worried if you can’t come up with that much money just yet, you don’t have to set it up with a huge amount, it can be $1! Just set it up as quickly as possible and start experiencing the automated process and understanding how it works.

Example: Paying an extra $1,000 each month on a $300,000 loan at a 3% interest rate will save you $90,514 in interest and over 16 years.

Quite often, especially with fixed interest loans, your lender or bank might not allow you to make higher or more frequent repayments so it’s good to check with them first. If they do, there could be a limit (for example $10,000 per year) so make sure you’ve confirmed with them that what you’re planning is allowed and that you won’t be penalised

If you’re in the US, you should also make sure to inform your lender that these additional repayments are to be applied to the principal, not interest. If you don’t, the lender can apply them to future scheduled repayments which won’t save you any money.

Have A Goal To Motivate You

It’s common to want to pay off your mortgage on the vague notion that you’d like to be richer or debt free. Common, but dangerous.

The problem with a fuzzy (or non existent) goal is that it’s all too easy to abandon. There is no way to measure success or to keep you on track and this vague “plan” will quickly be forgotten.

Even if you’re paying your mortgage off super quickly, say in 10 years, that’s still 10 years you need to keep up your motivation because without it, there’s sure to be something else to tempt your money away.

This is why having a specific, measurable goal is very important. Here are a few examples:

- To pay the mortgage off before I’m 30 / 35 / 40 / 45…

- To pay the mortgage off before we have children

- To be completely debt free within 10 years

Try and find out WHY you want to pay off your mortgage faster and put that reason in a very visible spot so you never forget it. Make sure it’s clear and on display so you’re regularly reminded about your goal. We recommend putting it in your free Excel Mortgage Calculator Spreadsheet as most people tend to review it regularly. It will also help guide you on what your exact repayments will need to be for your 10 year time frame.

Save Money

Once you’ve setup your extra mortgage repayments, goal and mortgage planning spreadsheet, you should focus as much time and energy as you can on learning How To Save Money. The more money you save, the more you can add to your extra mortgage repayments creating a debt snowball effect that is extremely powerful.

Even small amounts of income, such as bringing your lunch to work rather than buying it, can make a big impact. Try and focus on the biggest items first. Make a very rough list of your major expenses and then attack them one at a time from biggest to smallest. Once again, our Excel Mortgage Calculator Spreadsheet will help you with this.

Example: If you save $10/day by bringing in lunch, 5 days a week, that $50 a week added to the repayments. On a $300,000 loan at a 3% interest rate will save you $35,512 in interest and over 6 years.

For those who are after an even more advanced approach, we encourage you to push 70% of your wage to your mortgage when considering How Much Extra Should You Pay On Your Mortgage. This is what has allowed many of our readers to pay off their mortgages in well under 10 years.

Refinance Your Mortgage

This can be a huge double win if there are cheaper interest rates available. The best way to do this is not only refinance to the lower interest rate, but to then double up the savings by continuing to still pay the same repayment amount each month / fortnight.

Example: Refinancing from an interest rate of 3% to 2% and keeping the same repayments ($1,686/month) on a $300,000 loan will save you $97,676 in interest and over 4 years.

The other reason this is such a huge benefit is that it’s basically a free lunch! Your mortgage repayments don’t change yet you save a huge amount of time and money.

Use Unexpected Income

If you get any unexpected income such as bonuses, inheritance or tax returns you can throw them directly at your mortgage to help bring it down. For one time income sources it can help to keep 5% to spoil yourself with, while committing the remaining 95% bulk to the loan. This way you get a nice immediate and visible benefit from the income, whilst at the same time making great progress on your mortgage.

Even better is to use unexpected regular income such as money you make from a side hustle or small business. Even something as little as $100 extra earned per week can cut almost a decade off your loan.

Example: Adding just $100 a week of income from a side business to the repayments on a $300,000 loan at a 3% interest rate will save you $58,976 in interest and over 10 years.

Pay Off A 30 Year Mortgage In 10 Years – A Real Life Example

An Automatic $344,857 Saving In 1 Year

Like a lot of people, Jack and Jill (obviously not their real names) were an item for a while and decided it was time to buy a house and move in together. Not knowing too much about the whole process they stumbled through the contracts and negotiations to emerge on the other side standing in their very own (and mostly empty) house. In the back of their minds they both knew what the trade-off was though.

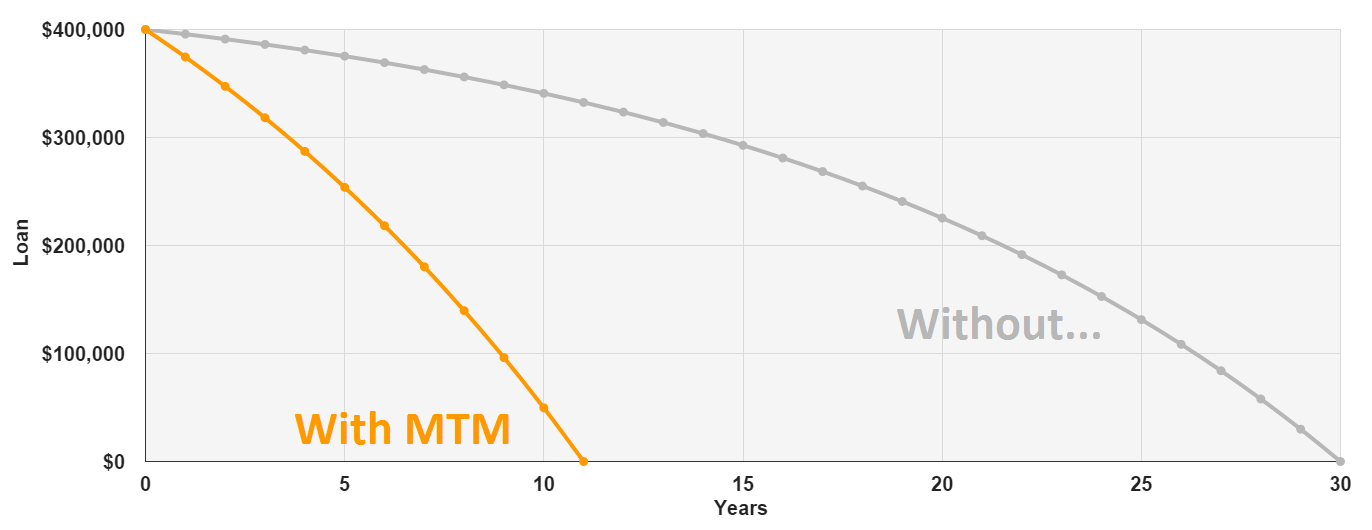

Loan: $400,000 @ 6.7%

Minimum Fortnightly Repayments: $1,200. Sentence: 30 Years

They were a bit worried about such a large amount of debt but it was “good debt” as everyone kept telling them. It was a necessary evil that all people just have to deal with in life you know? Sure it was annoying that every fortnight a huge amount of their hard earned money was being taken away from them. It was irritating to say the least, but they weren’t really too sure what they “should” be doing so for a while they just ignored it. Forgot about it or blocked it out like their student loan debt… best to just ignore it all. Besides, all it did was make them sad that there wasn’t anything they could really do about it.

This was back in 2009, so interest rates were a bit higher, but they figured that they should at least pay a little extra to get ahead, it’s the smart thing to do! So in July 2009 they began paying just $100 a fortnight more ($1,300 all up) and felt quite good that they could handle it comfortably.

A few months later in October they propped it up a bit more to $1,450. Sentence: 19 Years.

Even though they were only adding in an extra $250 a fortnight, they had already slashed away 11 years worth of their term! This gave them the encouragement and confidence they needed to continue pushing further and further, mutilating their mortgage week after week and as April of 2010 rolled around they upped it to $1,550 per fortnight. Sentence: 16 Years.

They weren’t just pulling this money out of nowhere either, every now and then they’d spend a few minutes discussing things and deciding where they wanted their money to go. Should it go to buying more shoes or clothes or cool gadgets (of which they already had many) or would they prefer to not buy so much crap and use that money to up their repayments instead?

In June of 2010 they had a much clearer understanding of all the bills, the payments, the money that was going in and out and so they knew they could increase it even more to $1,700. Sentence: 14 Years.

Spurred on by the fantastic results they were seeing for themselves and how easy it was (due to them all being Automatic, Extra Mortgage Payments), they once again pushed themselves a bit further in July 2010 to $1,900. Sentence: 11.5 Years (they later went on to further reduce this to under 10 years!)

In 1 year and with very little effort, they had taken their 30 year mortgage and reduced it to 11.5 years saving over $344,857 in interest.

They felt great about their mortgage! Proud. Happy that they weren’t throwing away all that money any more. That was money they would keep for themselves, money they would spend on worthwhile things, fun things! In fact they went on to spend some of it on a holiday going to a beautiful, private island in Fiji.

Bottom Line

It’s important to note that this couple is not earning $400,000 CEO salaries every year. They haven’t received any inheritances. They don’t even buy lottery tickets let alone have won any jack pots. This isn’t a scammy, get rich quick scheme that only works for the people on top or the 0.0001% of people that “make it”.

This result was achieved through specific, repeatable actions which you can do too and the results are achievable for everyone, even if you’re on a single income, even if you’ve got children. Heck, even if you are both those things there are already those out there using this knowledge and getting ahead:

We bought for $370K. We paid it off in 11 years with a single income and 3 kids

– Tim

So what are you waiting for? See how much extra you’ll need to pay with the below fortnightly repayments guide, check out more Mortgage Advice and start reaping the Benefits Of A Paid Off House today!

| Loan | 30Y Repayment | 10Y Repayment |

|---|---|---|

| $200,000 | $441 | $891 |

| $300,000 | $584 | $1,336 |

| $400,000 | $779 | $1,782 |

| $500,000 | $973 | $2,227 |

| $600,000 | $1,168 | $2,672 |

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).