Everyone knows they should have a decent sized home loan deposit when you’re a first home buyer here in Australia, but how much deposit do you need exactly?

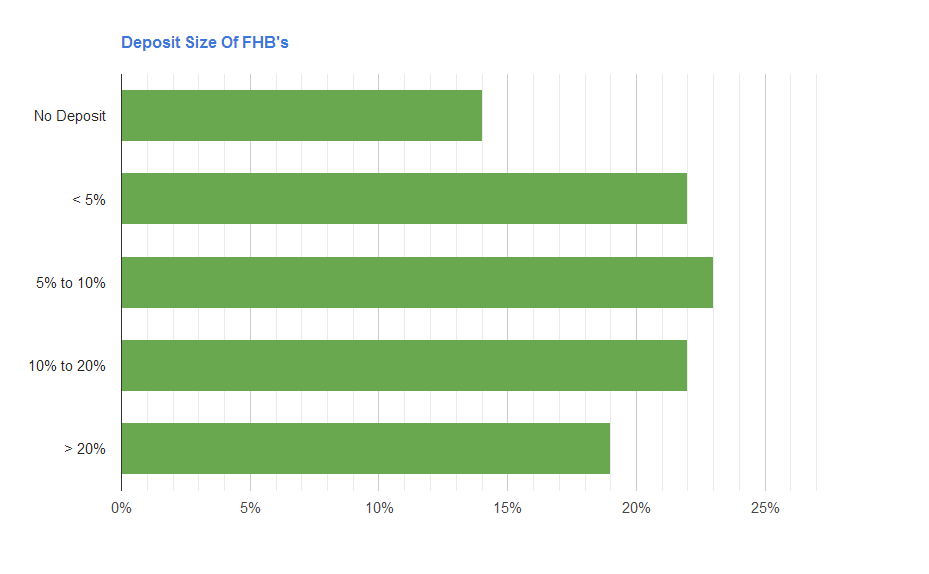

First off let’s have a deep look at what the general masses of Australia do when it comes to deposits for their first home. These facts, taken from the Australian Bureau of Statistics here (one of my favourite sites), gives us the following information from 2007-2008: So from this graph is pretty easy to see that the vast majority (14% + 22% + 23% + 22% = 81%) of FHB’s in Australia have between a 0% and 20% deposit. Assuming an average house price of around $300,000, that’s anywhere in between $0 and $60,000… quite a large gap. If you take just the < 5% to 20% range you get 67% and anywhere from around $3,000 to $60,000… still not much help!

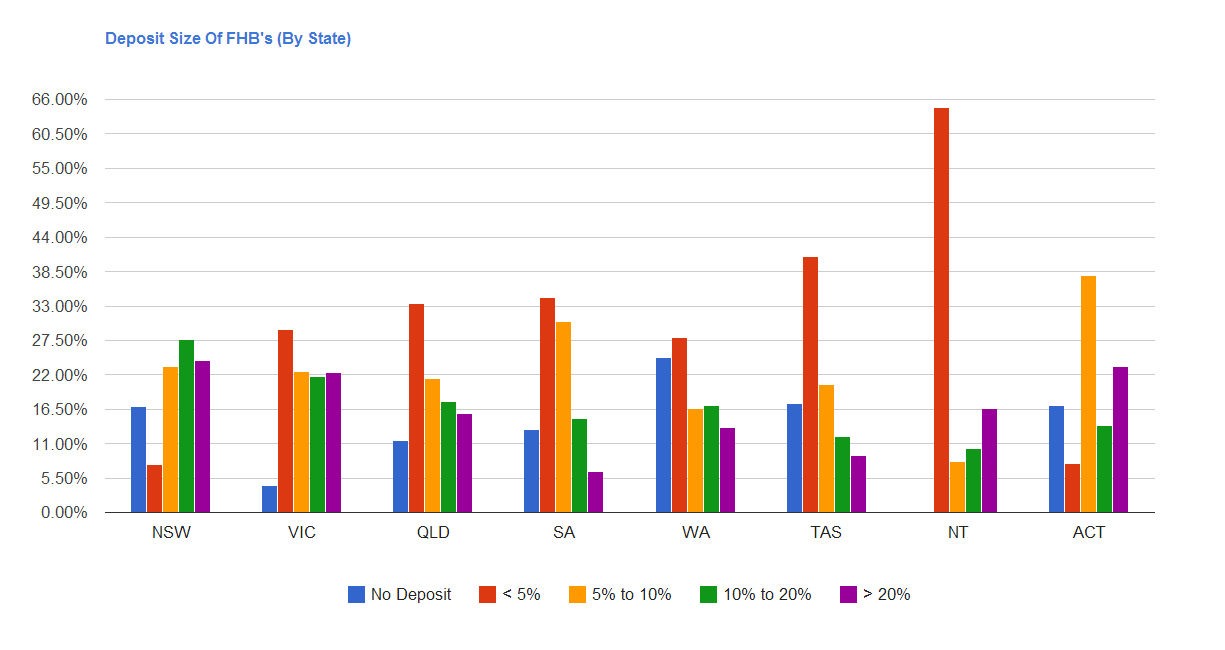

Now it turns out that this “decent sized house deposit” figure gets even harder to calculate because it of course depends on where you’re buying. The average for Australia is $45,000, however if you’re buying in NSW then the average is $61,000 and if you’re in Tasmania it’s only $16,000! It’s also made clear from the statistics that the vast majority of First Home Buyers have their deposit made up of their personal savings and the First Home Owners Grant, which you find info on here:

- First Home Owners Grant NSW

- First Home Owners Grant VIC

- First Home Owners Grant QLD

- First Home Owners Grant SA

- First Home Owners Grant WA

So that $16,000 for example could be made up of $7,000 in First Home Owner grants for an existing home and $9,000 in personal savings. Not to mention that these FHOG’s differ from state to state in Australia so it all gets quite complicated very quickly. So let’s break that above graph down a bit more so you as an individual can see how you’re doing compared to your other fellow state members:

Interesting… So what does it all tell us? It tells us that the answer is “it depends”. It depends where you live, it depends if you’re eligible for a FHOG, it depends how much your house is going to cost and likely a few other factors as well. Now this would be a pretty lame article if I just threw up my hands and said “Well, there you have it!”, so let’s dig even deeper. Let’s see if these figures match up with a few examples people have posted up online:

Whirlpool Forum: By year end we will have a about $80,000… Currently looking at QLD around the $350,000 to $400,000 price.

New Home Owner: It took me approx 9 months to save about $23,000 – $25,000 and I purchased an existing home in VIC for $300,000.

Looking To Buy Owner: I am saving around $2,000/month whilst I’m living at home and plan on building a new house for around $350,000.

These real (but anonymous) examples give us a deposit percentage of 20%, 8.3% and “unknown” respectively which seems to fit well into the above chart. However we’re still not really much closer to finding out an exact figure are we? Getting to the heart of the problem though this question of “How much deposit should I have?” generally comes from a single or couple that want to buy their first home.

Like most other people in the world, they want to buy it as soon as possible but they don’t want to make any mistakes if they can. So they might have $25,000 saved up but is that enough? Do they have to keep on saving more and waiting even longer? This is the real question they’re trying to answer, the question behind the question.

Lenders Mortgage Insurance:

Lenders Mortgage Insurance (LMI) is just like any other insurance out there, it gives the holder a sum of money if the insured event happens. Many people get confused over LMI though because usually when YOU pay for some insurance YOU get the insurance payout, that’s not the case here. A bank will tell you to pay for the LMI. The insurer will in turn cover the BANK if you default or can’t pay.

So if you purchase a $300,000 house using a $5,000 deposit… then skip town, the bank will sell the property to try and get their money back. However the house might only sell for $280,000 meaning the bank has leant out $295,000 and only been able to get back $280,000. In comes the LMI company though and they pay the bank the difference of $15,000. Now it’s insurance so of course it’s one trillion times more complicated than that but this is how it generally works.

Traditionally when you take out a mortgage of 80% or more of the value of the property then you’ll have to pay the LMI which is usually thousands of dollars. So if you want to buy a $300,000… but you only have $40,000 as a deposit (13.3%) then you’ll have to cough up even more for your house. It gets even worse as well because the lesser a deposit you have, the fewer banks there will be to choose from. Some banks flat out refuse any loan that’s doesn’t have a 20%+ deposit.

Others simply jack up their interest rates to account for the extra risk involved. By not hitting that 20%+ point you’re often kicking yourself TWICE. The trouble is though, getting that 20%+ deposit has gotten increasingly difficult over the years as prices in Australia have sky rocketed. When a house was four times the average salary back in around 1997 saving up for a 20% deposit meant saving $35,000, now a 20% deposit is $60,000 and that’s for a house far below the median price too!

We can’t control the price of houses generally and we can’t control the fact that banks demand LMI on any loan without a 20%+ deposit, but we CAN control how much we save and no one wants to pay thousands more for their home loan so let’s see if we can come up with a general structure that most people can follow to determine what a comfortable sized home loan is given where they live, the type of house they’re buying (new/existing) and how long it takes them to save.

The Right Sized Deposit For You:

The best thing you can do is avoid having to pay LMI. In this case, any deposit over 20% is fantastic, comfortable and you can officially “go nuts”.

If you’re reading this article though it’s likely because you don’t have a 20% deposit… but still want to buy a house now anyway. If this is the case, I can’t stress enough that you should try and wait as long as possible. Put as much effort into hitting that 20%+ deposit level. I know it’s hard, I know it takes years to save up for it quite often but it will save you thousands of dollars.

You’ll save on LMI (likely $2,000+ depending on your risk), you’ll save by being able to get a much better interest rate on your mortgage, you’ll save because you won’t be paying as much interest year after year on your mortgage and most importantly you’ll start off in your new home with an appropriate amount of debt.

Too many young adults purchase their first home leveraging up to their eyeballs. They’ll buy a $450,000 house with a $20,000 deposit and be instantly put under a lot of pressure with no room for any errors or unlucky breaks. It’s often worse as the ones who purchase with a smaller deposit are frequently the ones who lack the ability to save consistently in the first place, meaning they’re even less likely to be able to pay off their house.

Ultimately though the decision comes down to how “safe” you are.

You can purchase a $400,000 house with a 5% deposit and be perfectly OK. You can purchase that same $400,000 house with a 30% deposit and be OK too. The catch is though that if things start to go wrong early on into the mortgage you will have less wiggle room. If you put down a $20,000 deposit on that $400,000 house (5%) and three months into the mortgage you lose your job for half a year… will you be OK to make the repayments still?

A $380,000 mortgage at 7% has a minimum repayment of $1,161/fortnight, can you handle that? If you’d had a $120,000 deposit (30%) then the loan would be $280,000 @ 7% and the minimum repayments would only be $856/fortnight. Now a $120,000 deposit is quite a decent chunk of cash however it obviously allows for far more security during the mortgage and that’s the balancing act you have to solve.

How much security do you NEED and how much time do you HAVE?

If you’re perfectly happy with a good chunk of risk and feel very confident that your job is secure and that even without it you can still happily make the required mortgage repayments then you’re going to need less time to save (as you’ll be saving less). If you’re extremely paranoid about the current economy and would really like that added security that comes with having a smaller mortgage then you may need to save for 2-3 or more years to get that $100,000 deposit you need.

Then again you might be one of the rare and lucky few that have very generous parents to help build up your deposit in which case you get both a shorter savings period AND the security of a lower mortgage starting out.

Below I’ve summed up this general view in a handy dandy table. At this point I’d also like to say that this is simply my opinion. As stated, you can get a home loan with a 5% deposit! It’s not what I’d do as it starts you off on shaky ground and having to sell your home because you can’t afford the repayments isn’t something I’d wish on my worst enemy. So as always, information on this website is for general information purposes only.

| Safety Level: | Deposit Percentage: |

| Rock Solid Safe | > 20% |

| Quite Safe | 15% – 20% |

| Getting Safer | 10% – 15% |

| Very Little Wiggle Room | 5% – 10% |

| Not Allowed At Majority Of Banks | < 5% |

Do try and get to 20%+ if you can, if you find you can’t, take a look at the price of the house you’re buying, is it value for money? Is it overpriced? Should you be getting a reality check and realising your first home is just a starting place?

Many see a $500,000 house, calculate the 20% deposit to be $100,000 and decide it can never be done instead of realising that they most likely shouldn’t even be LOOKING at spending $500,000 on a house to begin with, it’s something you upgrade to. At some point you will be fed up with renting or living apart from your partner or just simply get booted out by your parents, but to be safe, to be at least a little safe get above the 10% mark.

Final Note:

One trap many Australian First Home Buyers fall into is the “I’ll just start looking…” rabbit hole.

We’re still saving for the deposit but we’re also looking online!

Sound familiar?

Some have discipline, they can look all the want at the shiny, pretty dream homes and just ignore the temptation, however most can’t. They will start looking at domain.com.au or realestate.com.au with the good intention of “sussing out the market” or “getting a feel for the prices” etc but it quickly turns into seeing a house they adore.

After this they might go see it at inspection and before you know it someone ELSE is bidding on the property! This sends people into overdrive and they push forward ALL their plans so they can also put in a bid too. It’s a slippery slope from just casually looking… to signing that contract and the entire real estate industry (the entire SALES industry in fact) spends millions figuring out how to get you to do this every year.

It sounds cold but just don’t look. Ever.

Don’t start thinking about how many bedrooms you want, don’t start thinking about where you want to live or whether it should be a new or existing, single or double story home just ignore it all. Those things come later, after you’ve read this post on How Much Can I Borrow?

Once you’ve gone through the steps there and determined your borrowing amount, then you can match it up to how safe you’d like to feel when you’re in your new home and THAT will tell you your savings goal. When you’re a month or two away from achieving that goal… THEN start looking because I can almost guarantee you the above slippery slope scenario will happen to you.

For Example:

John and Jane read the “How Much Can I Borrow” post and conclude that they would like their loan paid off within 10 years. After they input their income details to a repayment calculator it says they should be able to pay off a $280,000 loan @ 7% in 10 years. They also aren’t super paranoid about being rock solid safe all the time but are decently patient and can happily wait a while if needed so they opt for the “Quite Safe” option above and decide a 15% deposit will be a good goal.

Now $280,000 / 0.85 = a $50,000 deposit (roughly). The “0.85” figure comes from simply doing one minus your chosen percentage, in this example we have 1 – 0.15 = 0.85.

Now John and Jane can save just over $3,000 per month which means they should be able to reach that goal in 17 months (1 year, 5 months). Given this target, they’d likely want to start researching properties any time after the 1 year, 3 month period and they’d be looking for a $330,000 home.

So how are you going with your home loan deposit? Are you finding it super easy or super hard to get to your goal amount and how does it compare to the averages in your respective state?

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).