While loans usually have 30 or 15 year terms, it’s quite easy to learn How To Pay Off Your Mortgage Faster than that. But “faster” is a broad term, so how long does it take to pay off a house? The answer varies depending on your unique circumstances, but if statistical trends are to be believed, it seems that most take close to the full 30 years which can be a hugely costly mistake.

If you’re looking for a home loan payoff or repayment calculator, please see our free Excel Mortgage Calculator spreadsheet with amortization schedule.

Table of Contents

How Long Does It Take To Pay Off A House On Average?

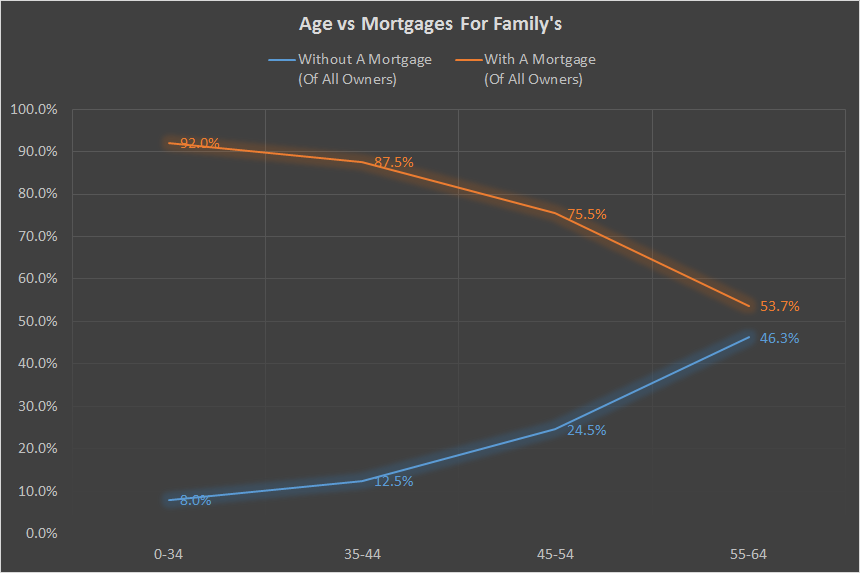

According to official statistics [source], there are quite different answers depending on your circumstances. Some families have children, some don’t. Some are single parents and sometimes it’s just a single person paying off a home loan. One of the most common scenarios is a family with children, which is what we’ll be looking at below.

As you’d expect, over time people gradually move from having a house with a mortgage to paying it down and then finally fully owning their homes. Interestingly it seems that if you have children and a mortgage now, there’s a 53.7% chance that you’ll still have a mortgage by the time you’re 65 and supposed to be retiring. This could be due to those people owning their principle residence outright, but still having a mortgage on a second property for investment reasons.

The main point is that people generally spend their whole adult lives trying to pay off their house. With 92% of home owning couple’s under 35 having a mortgage, even once they’re “over 65” more than half (53.7%) are still burdened with a mortgage. This is most likely due to the constant Lifestyle Inflation trap which has people buying bigger and fancier houses over time, never quite paying it all off and always being in debt.

Also interesting is that if you can manage to pay off your mortgage before you’re 35 (regardless of what household type you are) then you’re one of only roughly 0.58% households that do this (at least here in Australia) so you’re truly “the 1%”.

The Effects Of Different Loan Terms

While most have heard of compound interest, few fully appreciate how much of an impact it can make. The difference between paying off your loan in 30, 15, 10 or even 5 years will save you potentially hundreds of thousands of dollars in interest, however to get this benefit you’ll have to increase your repayments.

Before you start making extra repayments though, make sure you read through our piece Should I Pay Off My Mortgage? In it we go through all the pros and cons of when you should and shouldn’t pay off your mortgage early as it can sometimes not be the best financial move depending on your situation. If you decide it is a good idea though, let’s see how the extra repayment amounts and interest saved changes with an example 30 year loan of $400,000 at a 3% interest rate.

| Repayment Amount | Loan Term | Total Interest | Interest Saved |

|---|---|---|---|

| $779 / Fortnight | 30 Years | $206,703 | $0 |

| + $100 / Fortnight | 25 Years | $167,763 | $39,347 |

| + $250 / Fortnight | 20 Years | $131,203 | $75,908 |

| + $500 / Fortnight | 15 Years | $96,536 | $110,575 |

| + $1,000 / Fortnight | 10 Years | $63,368 | $143,743 |

As the Loan Term gets shorter, the interest has less time to compound on itself. This means you pay less of it, which can save you a significant amount of money. Banks and other lenders who have a vested interest in making sure you pay as much interest as possible often suggest low extra repayment amounts like $50 or $100 extra per fortnight. We recommend you aim for 70% though, as outlined in How Much Extra Should I Pay On My Mortgage?

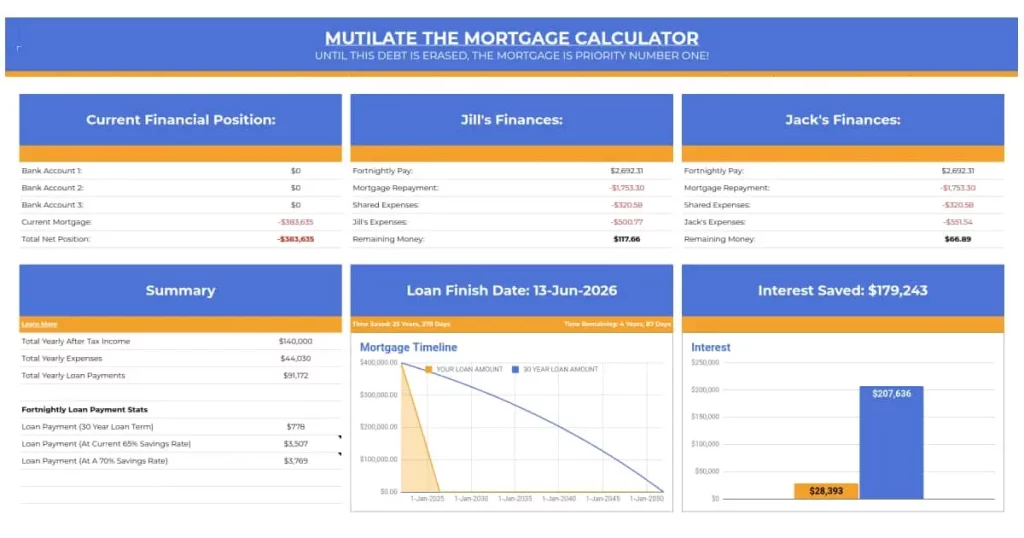

To help calculate your own extra repayments and see in real time on your own mortgage the effects of various loan terms you can use our free Excel Mortgage Calculator spreadsheet. It looks great, has amortization schedules & charts plus caters for singles, couples, helps track expenses and more!

How To Pay Off Your Mortgage Faster

Once you’ve decided to pay off your mortgage faster you’ll need a step-by-step process to help you. To begin with we recommend three core principles:

- Make Automatic, Extra Repayments Each Month: The single most effective way to pay off your mortgage faster is to make regular, automatic, extra repayments each month or fortnight. The recommended way to do this is to setup an extra Automatic, Extra Mortgage Payments each time your normal payment comes out. This allows you to not only change the amount quickly and easily in the future, it also makes the process automatic, greatly increasing the likelihood you’ll stick to it throughout the long term

- Have A Goal To Motivate You: It’s common to want to pay off your mortgage on the vague notion that you’d like to be richer or debt free. Common, but dangerous. The problem with a fuzzy (or non existent) goal is that it’s all too easy to abandon. There is no way to measure success or to keep you on track and this vague “plan” will quickly be forgotten. Try and find out WHY you want to pay off your mortgage faster and put that reason in a very visible spot so you never forget it

- Save Money & Increase Income: Once you’ve setup your extra mortgage repayments, goal and mortgage planning spreadsheet, you should focus as much time and energy as you can on learning How To Save Money. The more money you save, the more you can add to your extra mortgage repayments creating a debt snowball effect that is extremely powerful.

We go into more detail on these three core principless, as well as many others, in How To Pay Off Your Mortgage Faster. You can also read up on many of the rules that banks or lenders try and hide on our piece about Mortgage Advice.

Bottom Line

How long does it take to pay off a house? It’s entirely up to you and how motivated you are. Paying off your house certainly doesn’t have to take 30 years (or more) of your life. Experts suggest taking out a mortgage for that length because it enables you to have the most flexibility in what you pay each fortnight/week/month, but you should by no means be paying “the minimum” that the bank tells you to pay.

The truth is a house can be fully paid of in under 10 years if you follow our recommendations. There’s no magic pill or “trick”, it’s just proper and consistent work. It’s also highly recommended to start this repayment process as early as possible so that interest doesn’t get a chance to compound on itself.

FAQ

How Much Extra Do I Have to Pay?

As your loan term is reduced, you’ll need to pay a higher and higher repayment amount to make up for it. If you want to have a shorter loan term and the same repayment amount then you’ll need to reduce the size of your mortgage.

You can also leave the loan at the normal 30 year mark and instead pay extra repayments that will shorten it the more you pay. This is voluntary, so you’re always in control when deciding How Much Extra Should I Pay On My Mortgage.

Repayment Calculators

To help figure how long it will take for you to pay off your house there are an endless supply of loan repayment calculators out there. These show you charts, amortisation tables, interest amounts, repayment amounts and more to help you figure out what amounts work best for your loan.

Our free Excel Mortgage Calculator spreadsheet has all these features and more, plus it’s from an independent source that doesn’t have any conflicts of interest like banks or lenders do. It also helps encourage you to pay off your mortgage faster and has been proven to help get your loan term to under 10 years by thousands of people already.

Should You Refinance To A Shorter Term Mortgage?

Answering this requires a lot of information about your specific situation. In general though, most experts recommend keeping the official loan term at the standard 30 years. This ensures the repayment amount is as small as possible allowing you the most breathing room for when times get tough. When things are fine, you can then make extra repayments which will shorten the loan term.

To make sure you’ve taken all things into consideration and that you won’t put yourself into a worse off position by shortening your mortgage term, read through our piece Should I Pay Off My Mortgage? and then also be sure to speak with your lender about all the terms and conditions of the new, shorter loan.

What Happens After I Pay Off My Mortgage?

To begin with you should be aware that there are legitimate reasons that you might want to keep your mortgage at a very low amount rather than fully paying it off. This can be useful if you plan on buying investment properties in the future or simply need the cash for something else like a renovation.

If you’re certain you no longer need the mortgage then you will need to make the final payment with certified funds. What your lender considers certified will differ between companies and countries so it’s best to check with them directly. While checking you should also inform them that you wish to close the mortgage out fully and they will explain the process they have for this.

Usually this involves you filling out a form such as a Discharge Authority / Letter Of Instruction. These can also be call Payoff Letters but regardless of what it’s called it will help organise a few key things. First your lender needs to tally up any remaining payment amounts as well as any interest or fees that are payable.

They’ll also need to work with who ever holds the title deed for your property so that this is returned to you and transferred into your name. This ensures you fully own the property and that there is no longer a “mortgage” over it. This will also involve the local land transfer department to do the transfer which will usually involve a fee.

The benefits include: 1) How to pay off your mortgage faster than 99% of people with one hour a month of work 2) How to get rid of your debt and have the freedom to spend money on the things you love, guilt free 3) Clear outline of how to setup your expenses, mortgage and general finance 4) How offset accounts work and how to get the same result without being gouged by the big banks 5) How to cut through the crap and focus on the things that truly matter when taking down a mortgage 6) How to adjust the strategy so it works for you, even if you have kids, even if you only have one income 7) How to do all of these things and maintain a normal social life (and never be cheap).